What Role Does a PF Consultant Play in the Provident Fund Withdrawal Process?

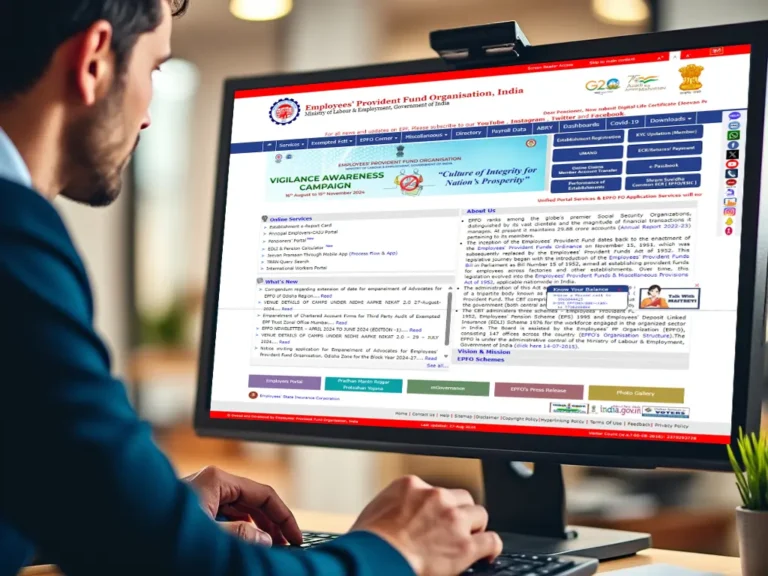

A PF Consultant simplifies the PF withdrawal process by handling documentation, tax implications, and EPFO interactions. They ensure a smooth and efficient withdrawal, saving you time and effort. EPF Buddy is a leading PF Consultant providing expert assistance for PF withdrawals.